Enhance your advice process with intelligent automation.

We bring smarter investment technology solutions to financial advisers, institutions and their clients.

We are creative, independent and thoroughly committed to building long term value for our customers.

request a demoOur Products

Portfolio Cloud helps organisations that are building or transforming their investment technology systems. By providing a robust and flexible framework, PorftolifoCloud has the solutions to work with you as your organisation grows.

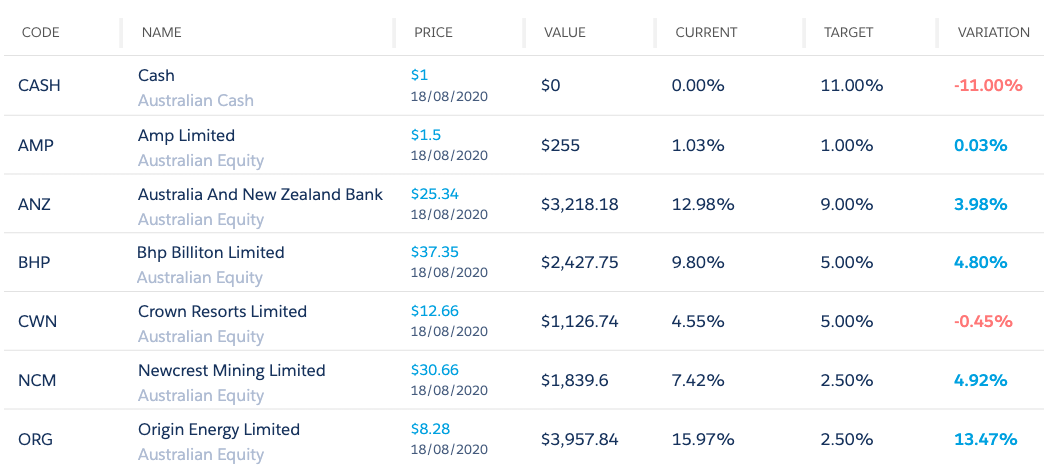

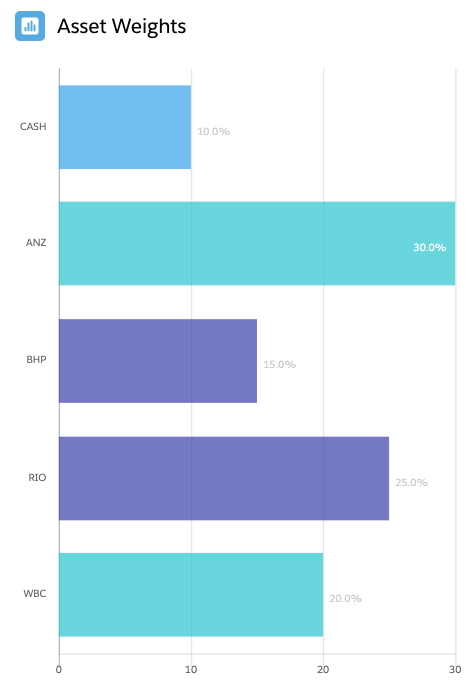

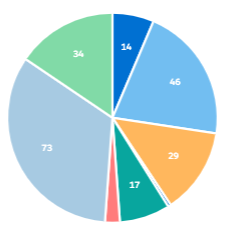

Portfolio management and rebalance technology

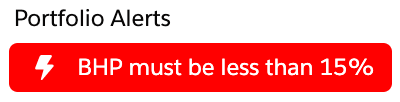

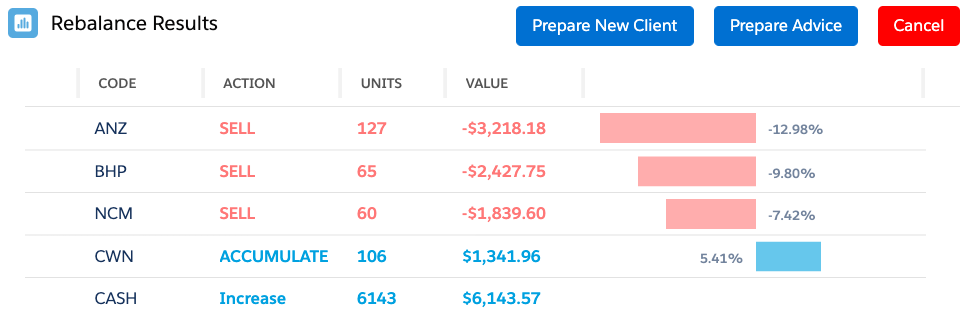

Portfolio Cloud’s institutional grade rebalance algorithms allow firms to optimise portfolios at speed, knowing the outcomes are governed by a robust compliance framework.

Portfolio personalisation, model portfolios, advice and APL management

Allow firms to grow and adapt their investment proposition as their business requirements change. Whether it be advised or discretionary, and whether firms use models or personalised portfolios, Portfolio Cloud allows firms to maximise their the efficiency while ensuring clients receive the best outcome.

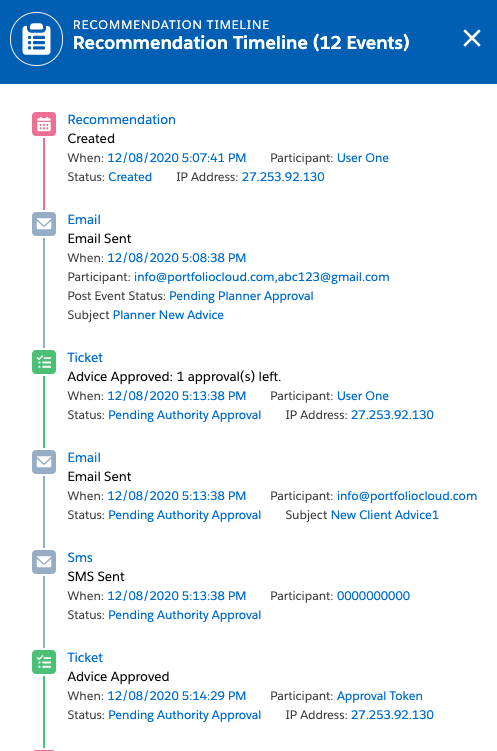

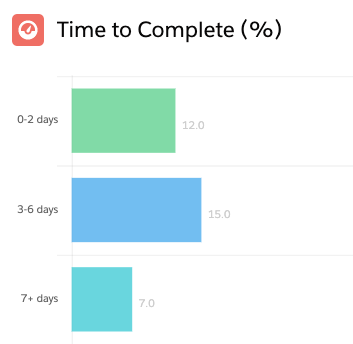

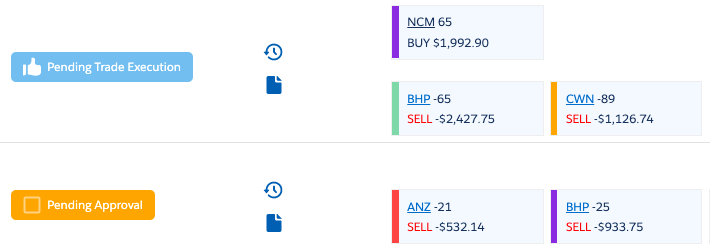

Automated advice workflow

Allows firms to scale complex advice processes, manage business rules and configure reports for clients.

Rules, access permissions and branding can be set by your organisation in a simple and flexible workpad.

Seamless investment trading is possible across multiple execution venues via straight-through-processing.

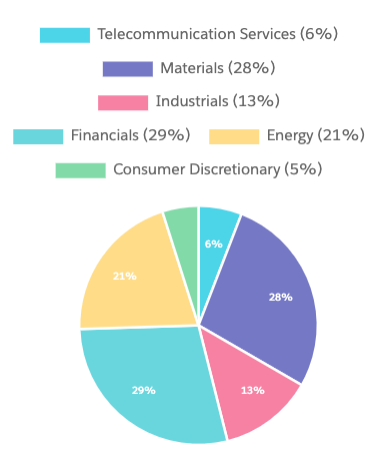

Centralised investment dashboard for advisors, investment teams and compliance managers

Allows firms to delineate their investment management and financial planning process. Centralised environments and dashboards empower stakeholders to monitor, research, and scale client portfolio interactions. Portfolio Cloud brings together multiple industry data sources, creating a streamlined process that drives productivity, client engagement and consistency in quality advice delivery.

Our API driven approach allows firms of any size to rapidly build or integrate bespoke applications into the Portfolio Cloud ecosystem.

Along with reducing administrative burden, Portfolio Cloud gives firms the flexibility to customize and control the client experience, integrate easily with other services and reduce layers of technical debt.

request a demoHow we help

Reliable cross-platform solutions for portfolio management and advice delivery have been costly and hard to find. Portfolio Cloud provides a user-friendly and cost effective alternative.

For firms operating a zero-custody model, Portfolio Cloud provides direct access to ASX Chess to give firms autonomy over their workflows and compliance rules.

API driven approach allows asset managers, stockbrokers and financial planners to take control of their operational and investment processes.

Powerful and user friendly platform helps firms attract, retain and improve the well-being of their financial advisers.

Portfolios can incorporate Stocks, Funds, Fixed Interest, Cash and other non listed assets. Portfolios can be modelled on an Asset Allocation basis or discrete single asset basis as defined by your firms investment proposition, risk profiles or client profiles.

Who we help

Advisers and Dealer Groups looking to control and simplify their advice processes and those looking to remove reliance on legacy providers.

Investment Managers looking to automate their business processes and collaborate more effectively with advisers, clients and platforms.

Wrap platforms looking to upgrade their investment tools and remain competitive in a rapidly advancing and competitive industry.

Stockbrokers looking for a ready-made advice process that can assist with a transition to holistic financial advice.

Our Technology

Portfolio Cloud's innovative technology framework provides a powerful and highly flexible suite of tools to automate and streamline end-to-end investment advice processes.

Portfolio Cloud’s low impact integration delivers a scalable and productive environment that can centralise your technology landscape without disrupting existing platforms or custody relationships.

Portfolio Cloud’s systems are hosted with leading cloud providers. Data is protected using enterprise grade controls to ensure privacy, protection and security.

Here's some of our customers

Open Architecture

Portfolio Cloud is an open infrastructure and built to support API connections. We are able to connect with administrators, trade execution platforms, ASX CHESS, investment platforms, CRM’s and Research providers. We are a centralised hub of operational and investment solutions for investment management firms.

Current Integrations

About Us

David Beggs

Co-Founder

David has over 17 years experience in the investment management industry. He recently held the position of Portfolio Manager at Metisq Capital, managing over $1 Billion in Emerging Markets equities.

He also held the position of Executive Director at Halidon Asset Management, managing fixed interest and hybrid assets. David’s work revolves heavily around quantitative investment and operational processes, with a focus on the development of trading, portfolio rebalancing and portfolio management systems.

In more recent years, David has been part of the core team that has been building the Portfolio Cloud product, his applied knowledge of the Agile methodology has provided the team with a foundation for fast growth and stability.

Leveraging his deep level of knowledge and experience in quant based portfolio management systems, David has lead the product development of some of Portfolio Clouds key features, such as Portfolio Rebalancing and Model Portfolios.

Matthew Cosier

CTO

Matthew has over 20 years’ of experience as a Software Engineer across a vast range of industries and disciplines, and has been writing software since he was 12 years old. Matthew found his passion in writing code by reading C/C++ books at his local library, quickly progressing into writing complex 3D partical simulators, 3D modelling applications and low level networking applications. Matthew slowly shifted his focus professionally to application development and selling software online. By the time he was 17, Matthew had completed a 2 year diploma in Software Development and progressed into University at a young age where he was hired by Microsoft during his Bachelor of Science degree. Microsoft supported him to complete his degree and taught him all about technology as a business by engaging in the enterprise sales process with some of their key clients in the Education space.

At Microsoft's recommendation, Matthew moved to one of their highest performing gold partners where he spent the next 4 years building his skills as an application developer, a presenter, and a contributor to the technology community. Matthew continued his journey by starting his own Consulting company where he provided unique skills to a number of large, well known organisations. His entrapraneurial spirit led him into the financial services space, where he met his Co-Founders and began the Journey of Portfolio Cloud. Now the CTO of Portfolio Cloud, Matthew designs, architects and implements some of the most high performing, cutting edge technology in the industry using best practice cloud computing techniques. Matthew is an expert .NET Developer, AWS practitioner, and enjoys producing products that are usable, fast, and enjoyable for his cutomers.

Mark Links

COO

Mark has over 20 years experience in Australia, UK and South Africa and has a history of scaling successful platform and advice businesses. He has held appointments as Head of Operations at Transact, the first UK open architecture platform which is now a $2b FTSE 250 company. He also held positions as CIO at Saunderson House and Operations Director at AXA Wealth Elevate platform. Mark has extensive experience in developing technology propositions and building scalable wealth management operations. Prior to this he was Managing Director at Confluent.net, a consultancy focussed on helping early stage SAAS platforms grow and expand.

John Beggs

Chairman

John was previously CEO of Metisq Capital managing Emerging Market equities. He has held appointments as the Head of Equities and Head of Global Markets at the Commonwealth Bank of Australia. While there he also managed large IT enterprises such as Australia’s largest retail stock broker CommSec. Prior to this, John was a Founding Partner and Executive Director of GMO Australia. He was also the founding Chief Executive of the Australian stock broking subsidiary of a large Japanese securities company Daiwa Securities. Before moving to Melbourne, for nine years John held academic faculty appointments at Yale University and the Australian National University. John holds a PhD in Econometrics.